Crypto OTC Trading

Over-the-counter (OTC) cryptocurrency brokerage firms operate as intermediaries for transactions with cryptocurrencies, as opposed to trading on controlled platforms. When opposed to public exchanges, over-the-counter trading offers a more private atmosphere because buyers and sellers participate in direct transactions without the inclusion of order books.

place with very little to no price slippage because of the improved liquidity of over-the-counter marketplaces. The resolution of over-the-counter (OTC) cryptocurrency transactions is typically more flexible and quicker than that of traditional exchanges. This is because counterparties demand a wide variety of settlement options.

It is important to note that trading cryptocurrency over-the-counter is not risk-free. In the context of a transaction, the term “counterparty risk” refers to the possibility that one of the parties involved would fail to fulfil their obligations and thus suffer damages. Transaction prices that are negotiated over the counter may differ from those that are published to the public for many reasons, including the reputation of the seller, the demand in the market, and the terms that were negotiated.

What is involved in trading cryptocurrencies over the counter?

The role of the broker is to mediate between the buyer and seller based on the specifics of the transaction, such as the amount and the price of the cryptocurrency. Preliminary discussions take place between parties to determine the asset’s price, the method of settlement, and the length of the agreement.

Since over-the-counter transactions are not recorded in the public order books, they are considered more confidential than exchange trades. Once conditions are agreed upon, the broker will make sure the transaction and settlement procedure are safe. For large transactions, there are a variety of methods that can be utilized for settlement, such as bank transfers, escrow services, and in-person meetings.

The ability to execute large trades without impacting market prices is a major draw for institutional and high-net-worth investors to over-the-counter trading. Thorough research must be conducted before engaging in over-the-counter (OTC) transactions to mitigate the risks associated with price volatility and counterparty default, while simultaneously making use of the advantages such as confidentiality and flexibility.

Different strategies for trading bitcoins as an alternative

It is possible to trade cryptocurrencies over the counter using a broad variety of strategies, each of which is adapted to meet the specific needs of an investor.

It is common practice for traders to make market-making offers, in which they offer to purchase or sell assets at predetermined prices, to increase liquidity. Through the use of the bid-ask spread, these traders want to place bets on price differences that exist between the over-the-counter (OTC) and exchange markets.

A further tactic is the utilization of arbitrage, which is a method that takes advantage of pricing differences that exist between different over-the-counter platforms and public exchanges. Price inefficiencies lead arbitrageurs to purchase assets on one platform at a lower price and then sell them on another platform at a higher price. This practice is known as arbitrage. Over-the-counter transactions can be automated by traders who utilize algorithmic trading, which allows them to better control risk and execute deals more quickly.

Over-the-counter traders utilize strategies like as hedging and portfolio diversification to further reduce the levels of market volatility. Traders may diversify their holdings among a variety of cryptocurrencies by using futures contracts as a means of protecting themselves from adverse price movements.

Traders need to apply strategic timing, which entails monitoring news events and market movements while making decisions on whether or not to enter the market or exit it. Successful over-the-counter traders have a solid understanding of market dynamics, strategies for risk management, and the flexibility to adjust to changing market circumstances. This is true regardless of whether they are making use of short-term price dislocations or surreptitiously completing big block trades without being discovered.

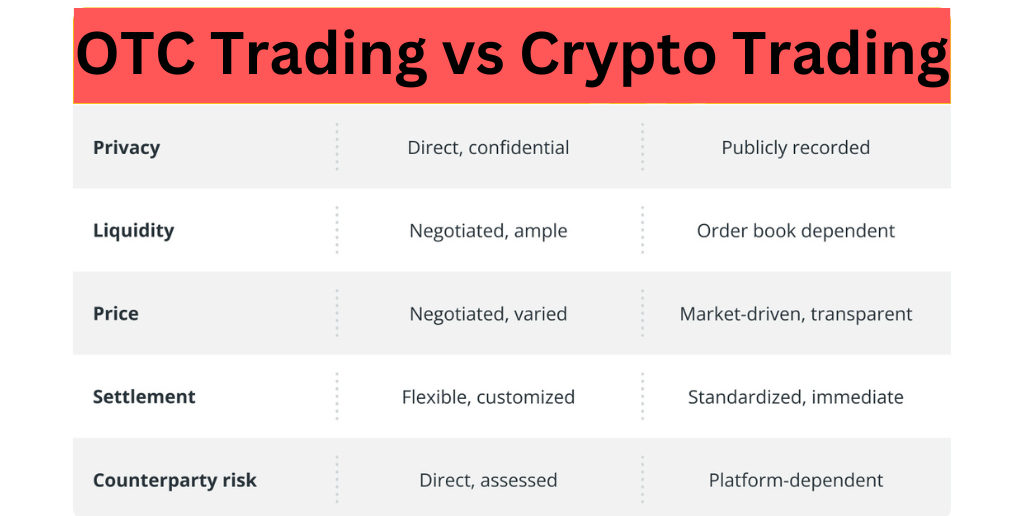

The trading of cryptocurrencies on exchanges and over-the-counter are compared and contrasted

Over-the-counter (OTC) trading and trading on exchanges are the two most frequent ways to sell and buy cryptocurrencies. Over-the-counter trading is a common alternative for large transactions that are brought about by institutional investors because of the anonymity and flexibility that are afforded by direct transactions between parties. However, because it takes place on open platforms with order books, exchange-based trading is more exposed to public scrutiny but less private.

The instantaneous execution of orders at the current market rate is made possible by trading on an exchange; nevertheless, the pricing of over-the-counter (OTC) transactions may differ from exchange rates because they are negotiated. In the Bitcoin market, the two approaches can satisfy a variety of demands and preferences. Here are some of how the two are different:

Advantages of trading cryptocurrencies over the counter

Because over-the-counter (OTC) transactions are conducted directly between parties and are not recorded in public order books, they provide a greater degree of confidentiality in comparison to exchange-based trading. This anonymity is particularly desirable to high-net-worth individuals and institutional investors who place a high priority on maintaining confidentiality in their business operations.

Furthermore, over-the-counter (OTC) markets often have a higher level of liquidity, which allows traders to conduct substantial deals with minimal to no price slippage. Over-the-counter (OTC) brokers can efficiently match buyers and sellers, even for extremely large transaction volumes, which contributes to this liquidity. The over-the-counter (OTC) markets, on the other hand, are less transparent than regular exchanges, which increases the likelihood of price manipulation and other fraudulent activities.

In addition, over-the-counter trading provides parties with increased flexibility in the process of trade settlement by enabling them to tailor the terms and processes of the settlement to match the specific requirements of their transactions. The absence of conventional settlement procedures in over-the-counter trading might, however, lead to conflicts and delays in the transaction process.

Crypto OTC Trading: regulatory considerations

Players in over-the-counter cryptocurrency trading are required to carefully handle regulatory factors to preserve compliance and decrease risks. around-the-counter (OTC) activity is being closely monitored by regulators from all around the world as the cryptocurrency market continues to expand. This is being done to prevent illicit activities including fraud, money laundering, and the financing of terrorist organizations.

Individuals who engage in cryptocurrency trading over the counter are thus expected to comply with a multitude of regulatory frameworks, including Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, amongst others. Transaction monitoring, the collection and validation of client data, and the reporting of suspicious conduct to the proper authorities are usually required to fulfil these obligations.

Therefore, for over-the-counter (OTC) trading platforms to function legally, they could be required to get licenses or registrations from a variety of agencies. This would make their regulatory compliance needs even more stringent. By adhering to regulatory norms, participants in the over-the-counter (OTC) cryptocurrency trading environment can enhance legitimacy, trust, and openness. Inevitably, this will eventually contribute to the long-term growth and viability of the sector.

FAQs 🙂

What Exactly is Crypto OTC Trading?

OTC trading is a marketplace without the constraints of traditional exchanges. For cryptocurrencies, it’s an arena where assets are bought and sold directly between two parties, without the oversight of an exchange. This method bypasses the order books and public trading. Think of it as a peer-to-peer transaction on steroids – characterized by large volumes of assets passing between parties at previously agreed-upon prices.

At its core, OTC trading offers privacy, flexibility in trades, and the potential to execute huge deals without causing the ripples or slippage often experienced in open markets. This is a market dominated by high-net-worth individuals and institutions looking to conduct transactions without the scrutiny of the open market.

How Does OTC Trading Differ from Exchange Trading?

On traditional exchanges, trading operates in a way that’s akin to the stock market. You place an order on a public order book, where it’s matched with another party. This transparent process can have the effect of moving the market, a dynamic known as slippage. OTC trading, on the other hand, is private and therefore spares the market from any impact.

OTC trading also allows for a range of trading options that are not possible in the open market. For instance, you can set your price and execute more complex trading strategies. This level of control makes OTC trading especially appealing to investors who have a specific trade in mind that they cannot execute on traditional exchanges.

What Are the Risks Associated with OTC Trading?

OTC trading comes with a suite of risks that mirror its benefits. Chief among these is counterparty risk, the chance that the person on the other side of the trade is unable to fulfil their part of the bargain. The lack of intermediaries and the private nature of OTC deals mean that due diligence is key in verifying the standing and capabilities of your trading partner.

Another risk is market risk. Essentially, when you agree on a price for a future date in OTC, you might find yourself disadvantaged when that date arrives and the market has moved significantly against your position.

Lastly, there is regulatory risk. Since OTC deals are largely unregulated, there’s the possibility of legal ramifications should a dispute arise, or if you’re not in compliance with the evolving crypto regulations.

How Can I Find Reputable OTC Trading Platforms?

The advent of OTC in the crypto space birthed a new type of platform designed to facilitate these trades. When selecting a platform, it’s crucial to consider factors such as security, the range of cryptocurrencies offered, fees, settlement periods, and, importantly, the reputation of the platform.

Look for platforms that have a history in the industry, and ensure they offer the level of security commensurate with the high volumes typically associated with OTC trades. A secure platform should have robust customer support and a clear protocol in place for dispute resolution. Research and due diligence are your allies here.

What Are Some Effective Negotiation Techniques for OTC Trading?

Unlike exchange trading, where prices are set by supply and demand, OTC deals are negotiated. Effective negotiation involves research into both the market and the party you’re trading with. Know what you want, understand the market’s condition, and be prepared to walk away from a deal if it doesn’t meet your criteria.

Building a good relationship with your counterparty is also crucial. Trust and reputation go a long way in facilitating smooth exchanges and repeat business. Develop a clear communication strategy and be transparent about your expectations and the terms of the trade.

Are There Regulatory Constraints in Crypto OTC Trading?

Regulations in the crypto space are still evolving, and this includes the OTC sector. While certain aspects of crypto trading are subject to regulation (such as anti-money laundering laws), OTC trading is generally less constrained than exchange trading.

However, as crypto becomes more mainstream and the market matures, OTC trading will likely come under closer scrutiny. Keep abreast of the legal landscape and ensure your practices are transparent and compliant with current and future regulations.

Can Individuals with Limited Capital Participate in OTC Trading?

The world of OTC trading is most certainly not just for the ultra-wealthy. Many platforms cater to a wide range of investment sizes. However, due to the risks involved, it’s advisable to start small and only increase your exposure as you become more familiar with OTC trading.

The emergence of fractional trading and trading apps has made it easier for individuals with limited capital to dip their toes into OTC waters. Just remember to exercise caution and never trade with more than you can afford to lose.

How Can One Ensure Security in OTC Trading Transactions?

Security should be your number one concern when engaging in OTC trading. This means securing your communication channels, using secure payment methods, and employing rigorous security measures for your digital assets.

You should use encrypted channels for communication and always authenticate the identities of the parties you are dealing with. When it comes to payments, consider using escrow services to ensure that funds are only released when both sides of the deal are fulfilled.

What are the Advantages of Using Escrow Services in OTC Trading?

Escrow services act as intermediaries in the OTC trading process. They hold the assets in trust until the conditions of the deal are met, providing security for both the buyer and the seller. This is especially important in large transactions where the transfer of assets is not immediate.

Escrow services can also provide anonymity in the transaction if that’s what both parties desire. The use of an escrow service can streamline the trading process and help ensure that the deal is conducted in good faith.

How Does One Handle Disputes in OTC Trading?

Despite the best-laid plans and precautions, disputes can still arise in OTC trading. The best way to handle a dispute is to have a clear agreement in place at the outset that outlines the steps to resolution.

If a dispute arises, open lines of communication are key. Try to resolve the issue directly with your counterparty first. If that fails, consider bringing in a third party, such as a mediator or legal counsel, to help facilitate a resolution.

What Are Some Emerging Trends in the Crypto OTC Trading Market?

The crypto market is constantly evolving, and the OTC sector is no different. Several trends are on the horizon that could reshape the landscape. These include the growth of decentralized OTC platforms, increased regulatory oversight, and the integration of OTC trading with traditional finance.

Additionally, as the market for digital assets matures, we may see a shift in the type of assets being traded OTC. The emergence of new asset classes could open up fresh opportunities and trading strategies.

You May Like These Posts Also 🙂

The topics covered here are always so interesting and unique Thank you for keeping me informed and entertained!

Give a round of applause in the comments to show your appreciation!

Keep up the fantastic work and continue to inspire us all!

This is such an important reminder and one that I needed to hear today Thank you for always providing timely and relevant content